The Definitive Guide for Mortgage Broker Vs Loan Officer

Wiki Article

8 Simple Techniques For Mortgage Broker Assistant

Table of ContentsA Biased View of Broker Mortgage Near MeSome Known Details About Mortgage Broker Vs Loan Officer The 6-Second Trick For Mortgage Broker Assistant Job DescriptionSome Known Incorrect Statements About Broker Mortgage Fees How Mortgage Broker Association can Save You Time, Stress, and Money.Some Known Questions About Broker Mortgage Near Me.

Do You Deal Aid Programs for Down Settlements? If authorized for a help program, you might be able to move into your new house more swiftly, select a 30-year lending at a set rate or obtain marked down exclusive mortgage insurance policy.Because saving enough for a down payment can take years for many prospective debtors, these support programs can make a big distinction in your capability to get a home loan for your desire residence. Make certain to provide the loan officer with lots of details regarding your scenario and respond to the questions they ask you.

If a number appears high or unusual, ask the lending policeman to clarify. What Is the Cost Estimate for the Lendings You Advise? An additional inquiry you might desire to ask when determining which lending officer is the best candidate for you is what their cost estimate is for the finance alternatives they recommend.

The Best Guide To Broker Mortgage Meaning

The estimates will be based on current passion prices that can transform, they can still give you a concept of what you can expect in terms of the price of the car loan. Demand these price quotes all on the same day so they can be fair, comparable quotes. Ask inquiries like these during the meeting with a car loan policeman.

Because guidelines are so strict, finance police officers should be highly educated concerning the borrowing process and the financial industry. The finance procedure, especially for mortgages, calls for a great deal of paperwork. While finishing the needed documents, you'll likely have several questions. A car loan policeman can use their experience to answer your inquiries and also assist you appropriately fill out the paperwork.

More About Mortgage Broker

Possess Superior Client Service Abilities, Among one of the most vital high qualities for a finance policeman to have transcends client solution skills. Great funding policemans make every effort to go beyond client assumptions, supply guidance as well as pointers certain to a debtor's demands and also to be available and receptive to the borrower as well as every person else involved mortgage broker how to become in the procedure.

A car loan officer ought to also be very easy to call, and they should maintain an open line of interaction with you. This will enable them to aid you via every step of the finance application procedure. 4. Offer Tips for Improving Certifications, Though a financing police officer can not make any type of issues in your credit rating go away, they can supply ideas for exactly how you can improve your credit scores and also various other qualifications for funding approval.

Some Known Incorrect Statements About Mortgage Broker Job Description

Communicates Well With Entailed Parties, While a loan officer will suggest you, problem numbers go to my blog and simplify your application procedure, their task entails a lot greater than documentation. An excellent loan officer will also interact well with the various other involved events, such as the expert. They'll work as your rep as well as remain in call with every person involved so you don't have to./mortgage-broker1-4eb1e0febc8548dc8e1b26a407116fff.jpg)

We're an independent, full-service loan provider as well as we allow our consumers to acquire their desire homes, whether it's their initial residence, a holiday residence or a financial investment residential property. We bring integrity as well as sincerity to our job and make every effort to do what's ideal for our clients. We're accredited in 39 states as well as housed in 20 places.

Examine This Report on Mortgage Broker Vs Loan Officer

Obtain a lending in under 15 mins with our electronic lending aide, Abby, today!.You have actually discovered the best house. Or possibly you're wishing to purchase a financial investment property, but you're unsure just how to deal with it. You recognize that you'll require to get a finance. Exactly how hard can it be? When you're acquiring a residential or commercial property, you're having fun with huge numbers. That can be terrifying.

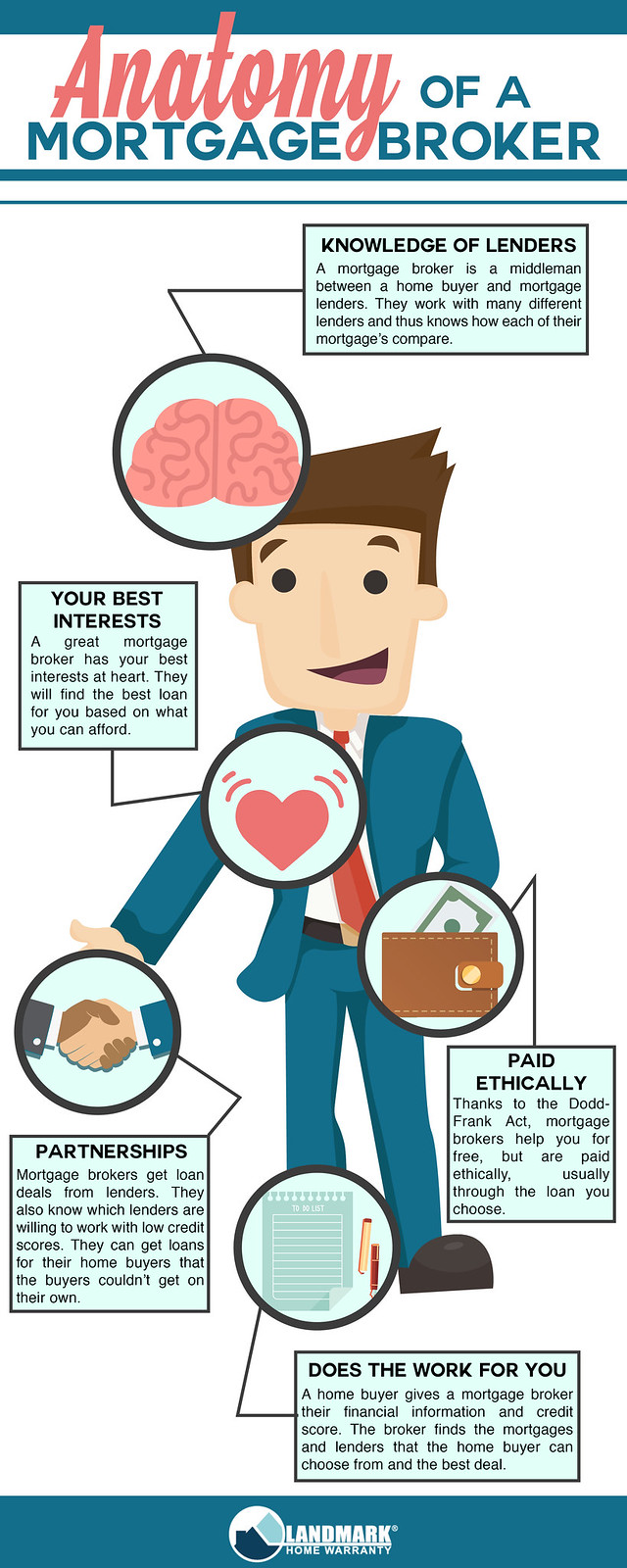

A home loan broker is someone that will certainly aid you not to allow your emotions shadow your vision of your goal. They wish to see you get your residence equally as high as you do, but they're likewise able to go back from the feelings of the process and also do what needs to get done.

Mortgage Broker Vs Loan Officer for Dummies

A mortgage broker will certainly help you discover a great home-loan. They'll locate you see this here a lending institution with competitive prices and excellent features. But that's not all they'll do. They'll stroll you via from the minute you primary step right into their workplace, to the day when you get the secrets for your residence.Report this wiki page